For a copy of the full report please contact us at info@housesinibiza.com

Dear Clients & Friends,

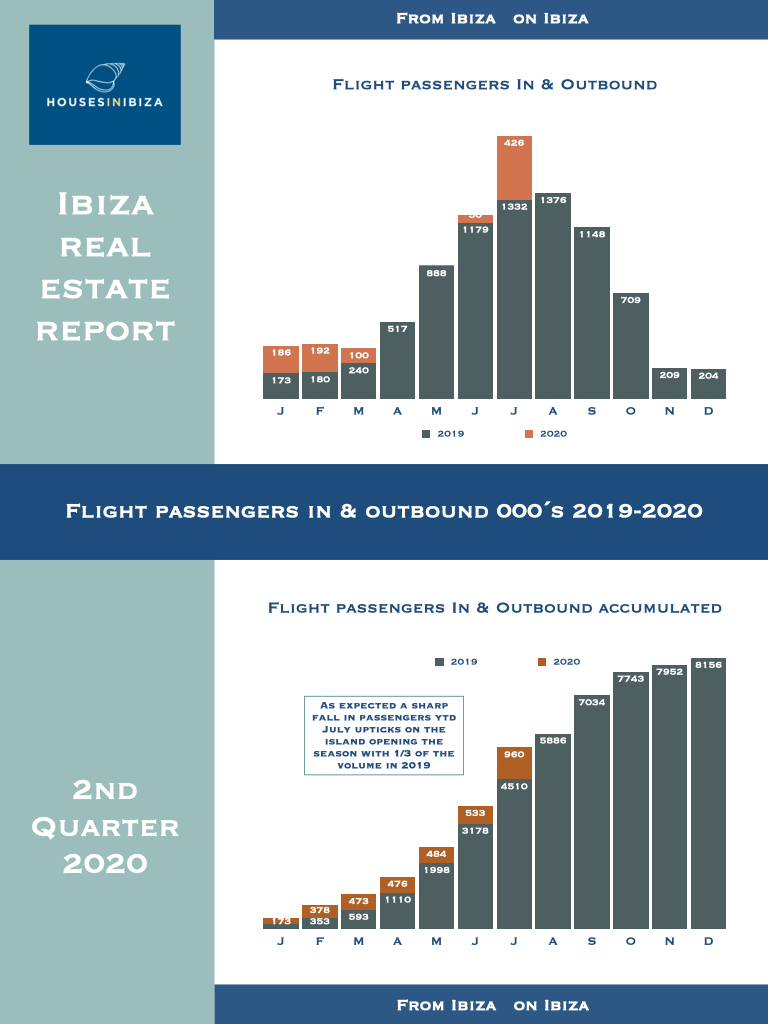

Ibiza managed to orchestrate a delayed opening in July and at this point it looks like it will be a short one. It will be a very weak season albeit slightly better than expected earlier in the year.

The Covid 19 crisis will no doubt have an impact on the island economy which relies almost entirely on tourism at least for the coming quarters.

What does this mean for the real estate sector in Ibiza?

We think that there will be 2 very differential impacts. The market under € 1 million will no doubt be affected with fewer transactions, lower rental incomes and a precarious buy to rent market which will result in some downward pressure on prices and a slow market for the next few quarters.

On the other hand the premium market will continue to see demand at realistic price levels as quality of life has experienced a revaluation on the back of confinement and has created a comparative advantage of being on the island.

We have seen a reasonable amount of buyers interest during the summer with buoyant demand at the right price levels.

There is a re validation of the Ibiza lifestyle option as a high quality of life, and relatively safe, alternative. Good internet connection is in high demand, the rest Is easy!

In addition, the prime rental market has also experienced reasonable demand as the market has seen more comfort in renting homes rather than staying at hotels for short term stays or for longer term, professionals looking to change capital cities for a finca in the countryside with good WiFi as a base for home working.

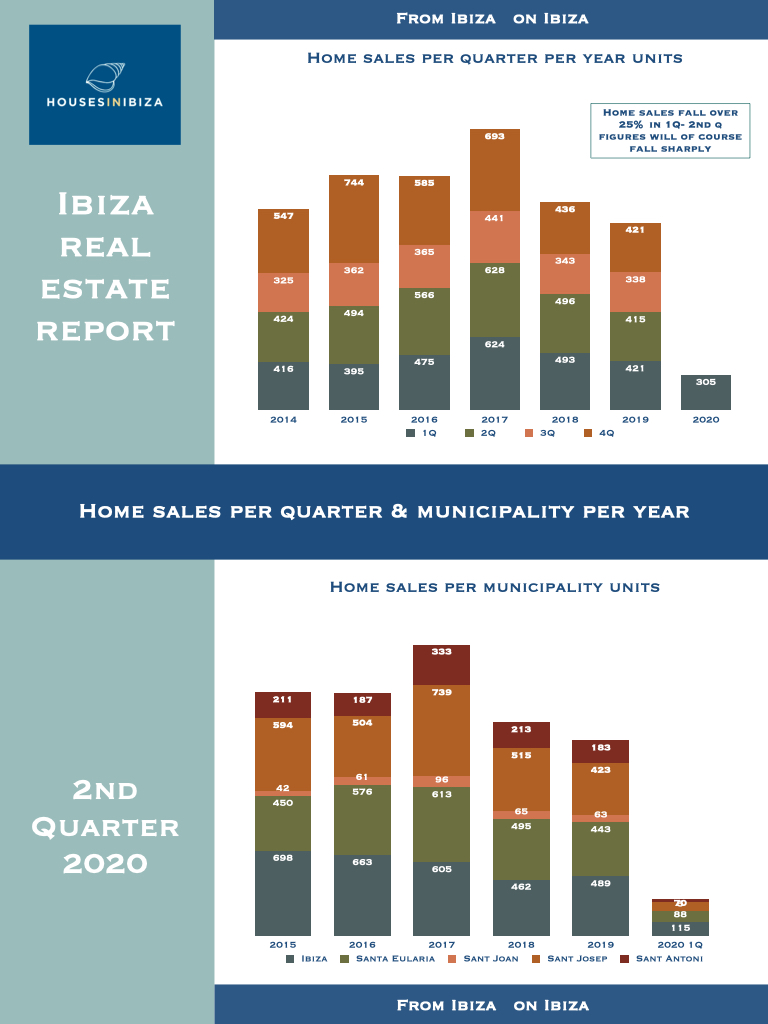

Transactions are down over 25% in the 1Q20 and 2Q is looking to be also drastically lower. There is pent up demand and June / July has been fairly busy still we would still expect to see sluggish comparative sales in coming quarters.

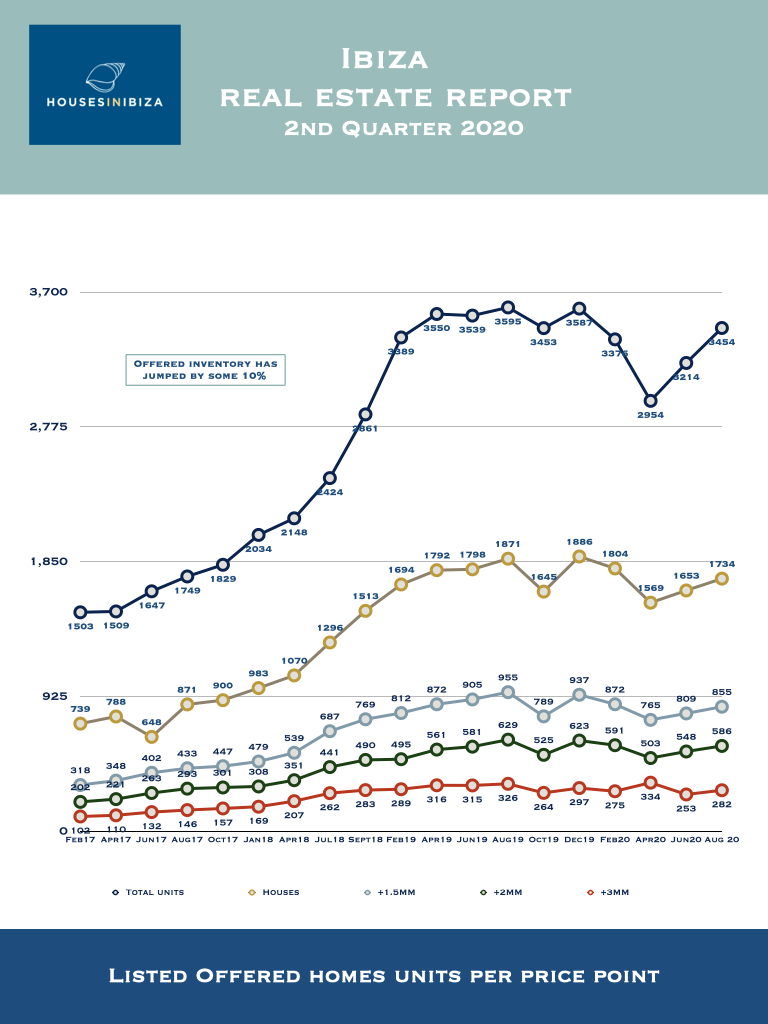

Not surprisingly Prices have been slightly softer accentuated in 2Q20 and listed inventory for sale has increased by over 10%.

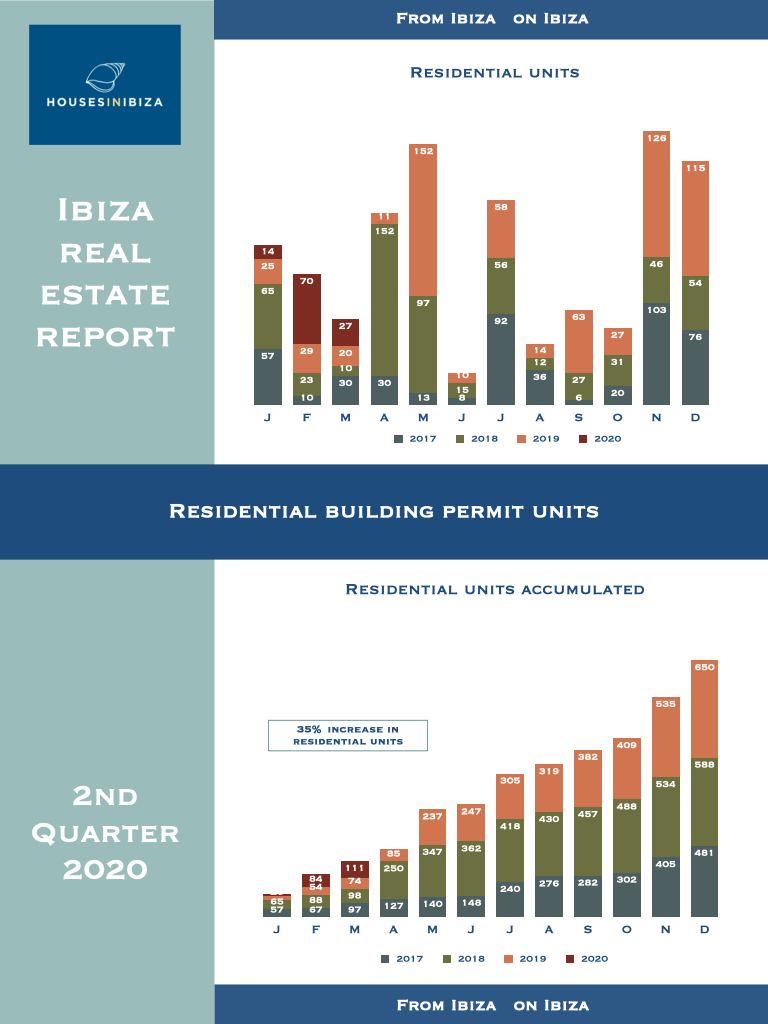

Mortgages issued have increased in size and number as have residential building permits in units,Spend and size, though total residential permits are slightly down.

We do not think that we will see any significant price falls in the upper segment of the market in coming quarters. Possibly properties with over realistic pricing will be marked down to real market levels but for the rest we expect to see prices hold.

The market will no doubt be slow and cautious but the undertow for the premium market is still there and while some of the buy to let investors may stay on the sidelines for the moment, price will not see huge discounts!

A good time to be following closely if you are a buyer, no hurry but do keep your eyes and ears open more for the right kind of property rather than a super bargain price!

In the meantime keep safe and look after one other

Clive Heathcote